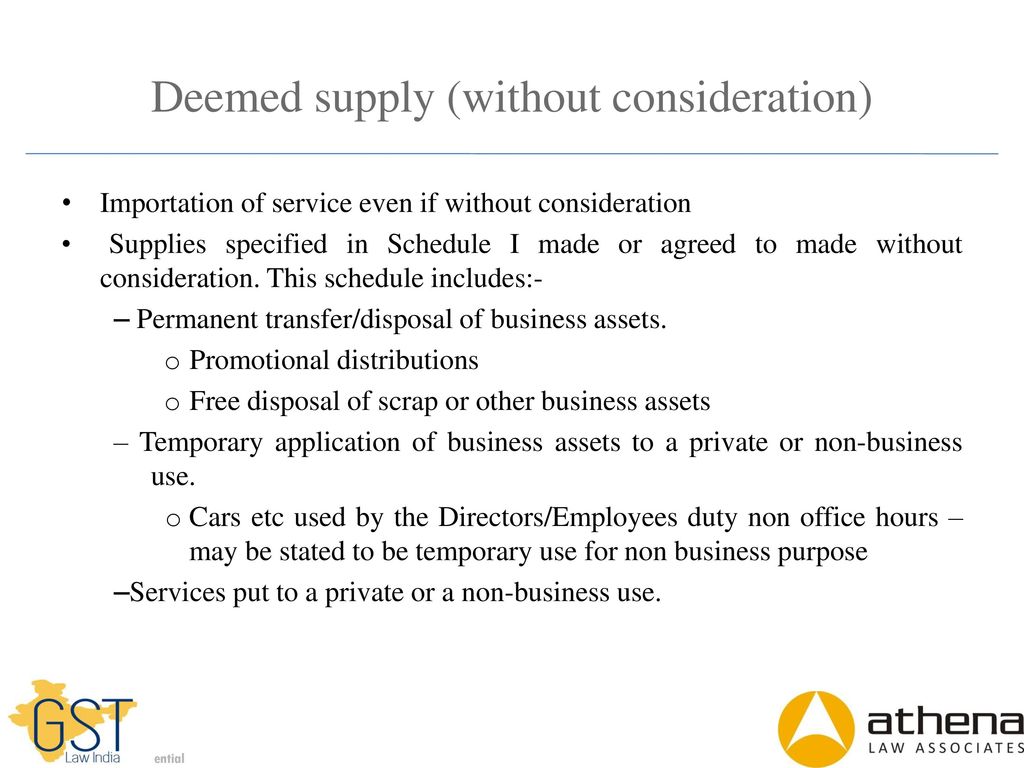

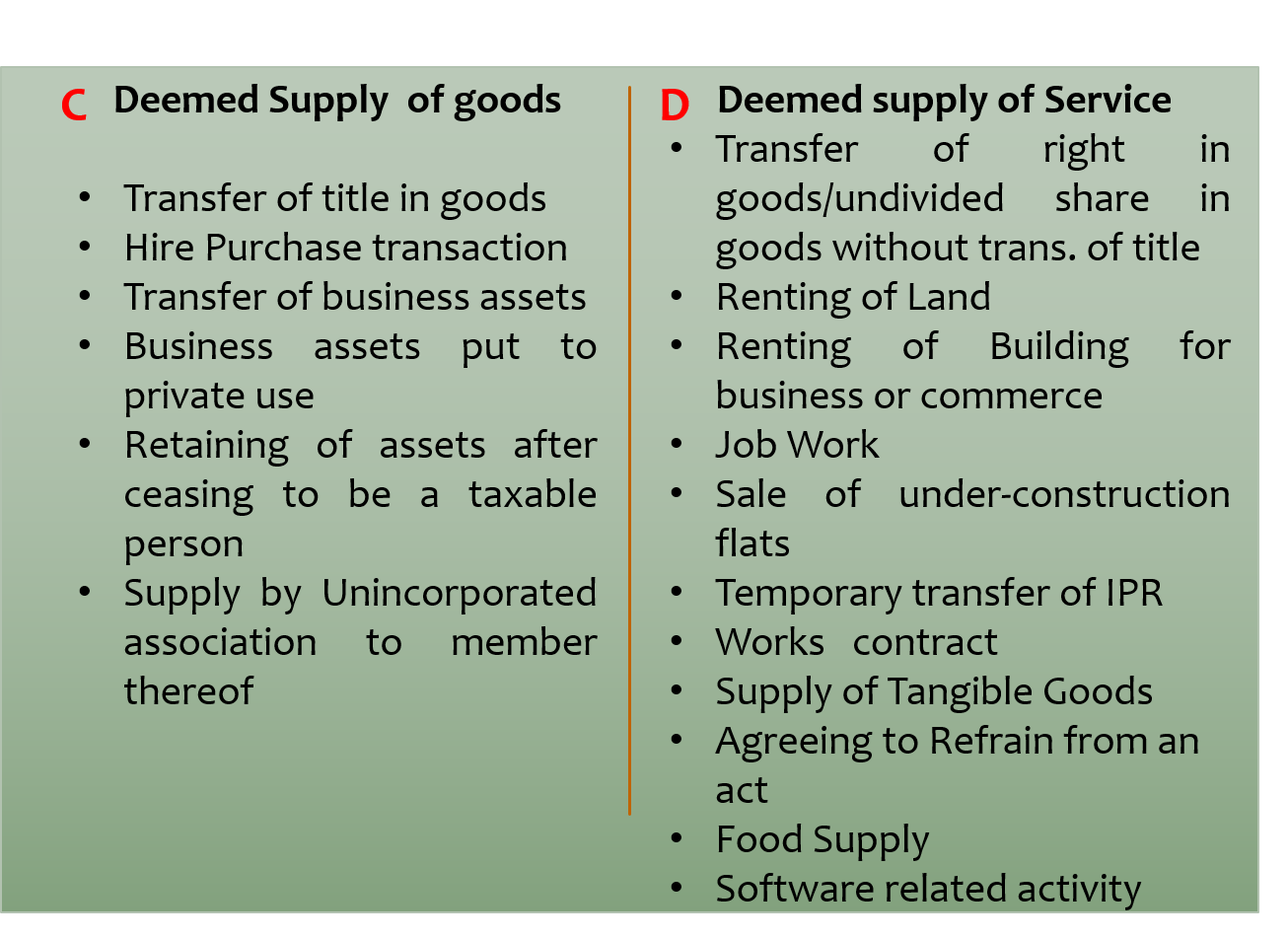

Schedule 1 - GST || Deemed Supply || Supply Under GST || CA IPCC/Inter/Final || Simple and Short - YouTube

Supply under Goods and services Tax Keshav R Garg (B.Com, FCA, CS, ISA(ICAI)) Faculty on GST – Indirect Tax Committee of ICAI Author – GST Ready Reckoner. - ppt download

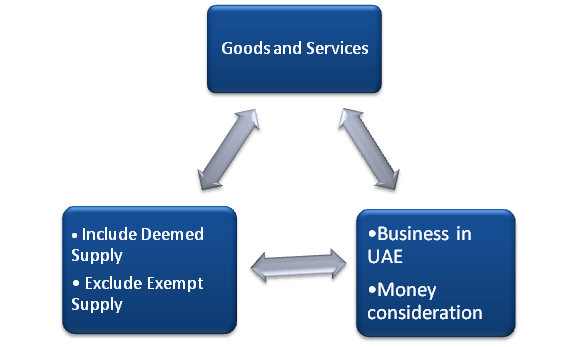

Indirecteducation on Twitter: "Taxable Event under GST i.e. #SUPPLY (Briefing the Scope of Supply under #GST) #concept #GSTSimplified #GSTinformation #indirecteducation https://t.co/bt9Im1TweC" / Twitter